The financial challenges facing U.S. military households are a significant concern throughout the year. Holidays such as Memorial Day, Armed Forces Day, or Veterans Day highlight the ongoing struggles that service members face, particularly amid rising costs for everyday essentials. Recent data from the U.S. Census Bureau’s Household Pulse Survey shows a troubling trend: Military personnel and their families are finding it more difficult to cover basic household expenses such as food, housing, and transportation than the average American.

Our analysis examines how service members are faring in today’s economy compared to civilian households, highlighting the states where military families report the greatest challenges in managing their finances.

As we enter Giving Season, we’ve also highlighted meaningful ways to support service members and their families through charitable contributions, offering an opportunity to make a direct impact on those who serve our nation.

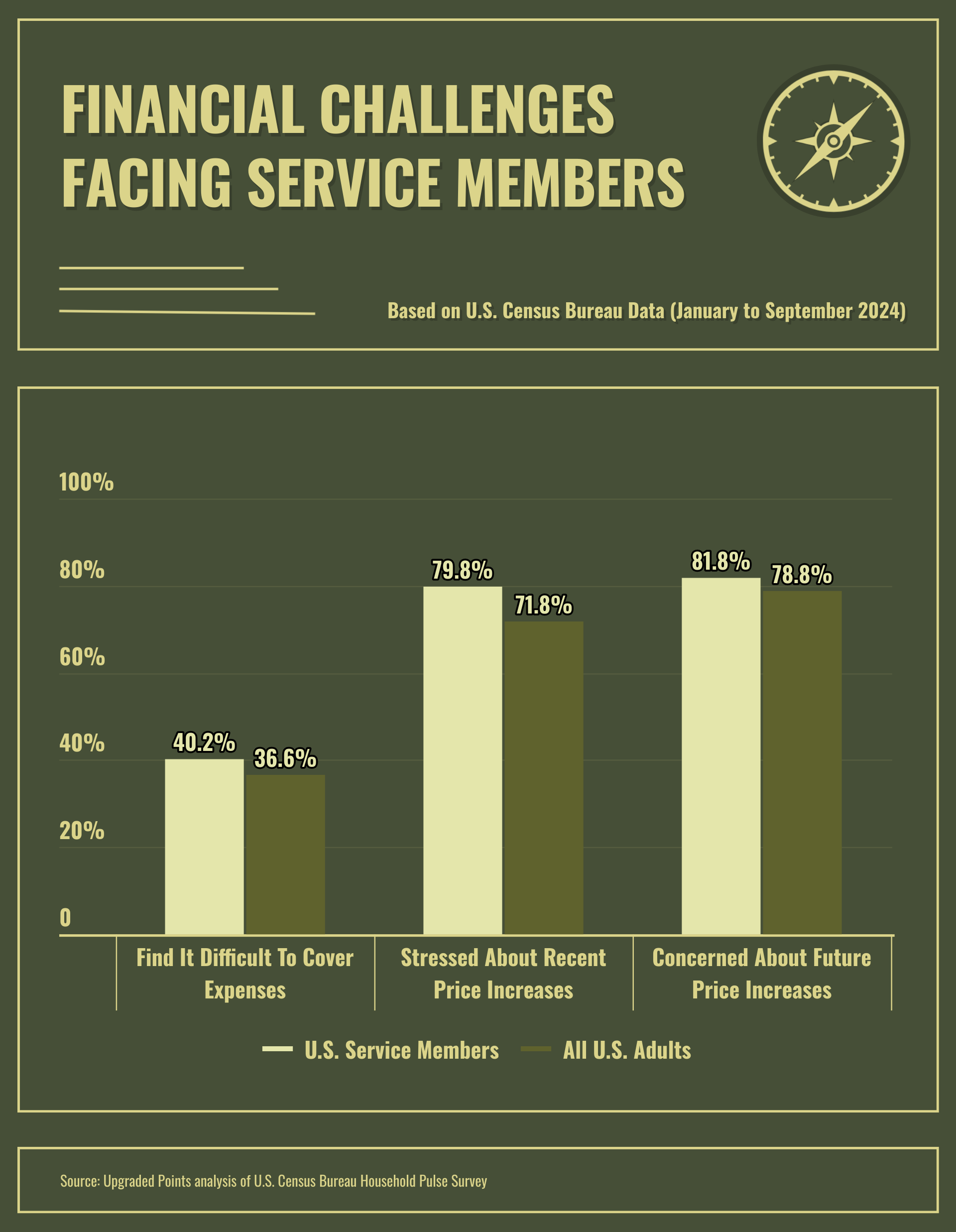

Financial Challenges Facing Service Members

Service members are struggling more financially than the average American. Image Credit: Upgraded Points

According to recent Household Pulse Survey data, members of the armed services are experiencing financial strain at higher rates than the general U.S. population. Over 40% of service members report difficulty covering their usual household expenses, compared to 36.6% of all U.S. adults.

The data also shows heightened anxiety among service members regarding rising prices. Nearly 80% of military personnel express stress about recent price increases, significantly higher than the 71.8% of all U.S. adults who share similar feelings. Furthermore, 81.8% of service members are concerned about future price hikes, reflecting widespread uncertainty about inflation’s long-term impact on household budgets.

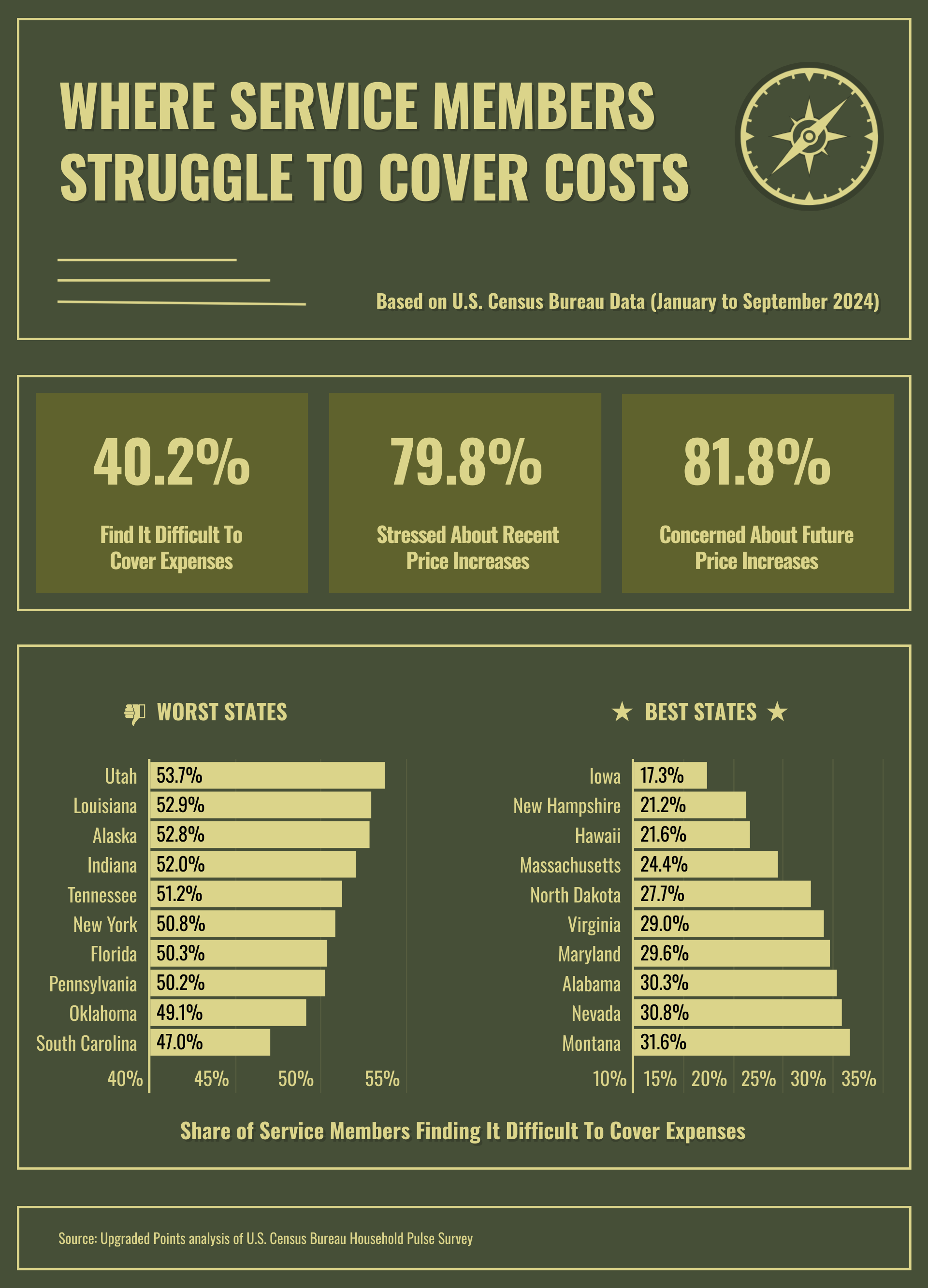

States Where Service Members Struggle To Cover Costs

More than half of service members in certain states have difficulty covering basic household expenses. Image Credit: Upgraded Points

Across the U.S., the financial burden on service members varies significantly from state to state, primarily influenced by local economic conditions. According to the most recent data, Utah leads with 53.7% of service members reporting difficulty covering basic household expenses, closely followed by Louisiana (52.9%) and Alaska (52.8%). Other states where over half of service members are struggling include Indiana (52.0%), Tennessee (51.2%), New York (50.8%), and Florida (50.3%).

A key issue service members frequently raise is that their Basic Allowance for Housing (BAH) has not kept pace with the rapidly rising cost of housing. In states where service members face the greatest financial difficulties, such as Utah, Indiana, Tennessee, and Florida, home price increases have far exceeded the national average, exacerbating the strain on household budgets.

Another critical factor affecting military families is the employment challenges military spouses face. According to the Department of Defense, the military spouse unemployment rate was 21% in 2023, compared to a national rate of 3.6% that year. Many military bases are located in rural or remote areas, limiting job opportunities for spouses, particularly in specialized fields. Additionally, frequent relocations make it difficult for spouses to sustain long-term careers, especially for those in professions requiring state-specific occupational licenses that can be difficult to transfer.

Service members are also more likely to report financial struggles in states with higher-than-average unemployment rates, such as Louisiana, Alaska, and New York. Conversely, the state unemployment rate is below average in 9 of the 10 states where service members report the least financial difficulty. This suggests that strong local employment opportunities, particularly for spouses, significantly ease the financial burden on military households.

How You Can Help: Top Military and Veteran Charities

Photo Credit: Bumble Dee / Shutterstock

One of the most impactful ways to support service members, veterans, and their families who are facing financial hardships is through donations to reputable charities. These organizations are dedicated to addressing the unique challenges faced by military families and veterans, providing vital assistance in areas like housing, medical expenses, scholarships, and career training. To help guide your generosity, we’ve compiled a list of top-rated charities based on scores from Charity Navigator, CharityWatch, and GuideStar, which assess organizations on criteria such as impact, efficiency, accountability, and transparency.

Here are some of the best charities supporting military families and veterans in need:

1. USO

For over 80 years, the USO has provided crucial support to active-duty service members and their families. From financial assistance programs to community-building initiatives, the USO helps service members stay connected to loved ones while addressing their most pressing needs during deployments and transitions.

This charity is focused on providing specially adapted homes for severely injured post-9/11 veterans. It helps veterans regain independence. Homes For Our Troops also provides financial planning and household budgeting to ensure long-term stability for the recipients.

3. Iraq and Afghanistan Veterans of America (IAVA)

Dedicated to advocating for veterans of the Iraq and Afghanistan wars, IAVA works to improve government policies and programs that support military families. Its advocacy ensures veterans have access to financial resources, healthcare, and education opportunities.

This foundation builds “comfort homes” near military and VA medical centers, allowing families to stay free of charge while a loved one is hospitalized. By reducing travel and lodging expenses, Fisher House eases financial stress during difficult times.

Offering a range of programs focused on financial stability, wellness, social support, and education, Hope For The Warriors provides critical support to service members, veterans, and their families. Its services include direct financial assistance for transitioning service members and veterans in need, career training and job placement, and scholarships for spouses.

Semper Fi & America’s Fund assists wounded, ill, and injured service members and their families through direct financial assistance and case management during hospitalization and recovery. The organization also provides educational support, career assistance, and health and wellness services.

7. Wounded Warriors Family Support (WWFS)

WWFS supports families of those wounded or killed in combat through programs like medical travel grants, meal and housekeeping assistance, in-home care services, and family retreats. By addressing these families’ immediate and ongoing needs, WWFS alleviates the financial burdens of those suffering from recent tragic events.

For more information, a detailed methodology, and complete results, see Rising Costs Hit Military Families Hard: Here’s How You Can Help on Upgraded Points.

Methodology

Photo Credit: Jacob Lund / Shutterstock

Upgraded Points conducted the analysis using the latest data from the U.S. Census Bureau Household Pulse Survey Phase 4.0–4.2, covering the period from January 9, 2024, to September 16, 2024. Service members were defined as adults currently serving in the U.S. armed forces (Active Duty, Reserve, or National Guard) and their spouses.

This analysis focuses on 3 key questions from the survey:

- Difficulty Covering Household Expenses: Respondents were asked, “In the last 7 days, how difficult has it been for your household to pay for usual household expenses, including but not limited to food, rent or mortgage, car payments, medical expenses, student loans, and so on?” We defined difficulty as either “very difficult” or “somewhat difficult.”

- Stress Due to Price Increases: Respondents were asked, “How stressful, if at all, has the increase in prices in the last two months been for you?” We defined stress as either “very stressful” or “moderately stressful.”

- Concern About Future Price Increases: Finally, respondents were asked, “In the area you live and shop, how concerned are you, if at all, that prices will increase in the next 6 months?” We defined concern as either “very concerned” or “somewhat concerned.”

Statistics with fewer than 50 survey responses were omitted from the analysis. Additional statistics on home prices were sourced from Zillow’s Home Value Index, and unemployment rates were sourced from the U.S. Census Bureau’s 2023 American Community Survey 1-Year Estimates.

For complete results, see Rising Costs Hit Military Families Hard: Here’s How You Can Help on Upgraded Points.